by Ryan H. Law

Many of us measure quantitative numbers to see if our clients are progressing towards financial well-being. Common forms of measuring include ratios, balance sheets, and net worth.

While all of these measurements are valuable, what about the qualitative side? How is the client feeling about their progress? One of my favorite tools to track this is from the Consumer Financial Protection Bureau (CFPB) with their Financial Well-Being Scale.

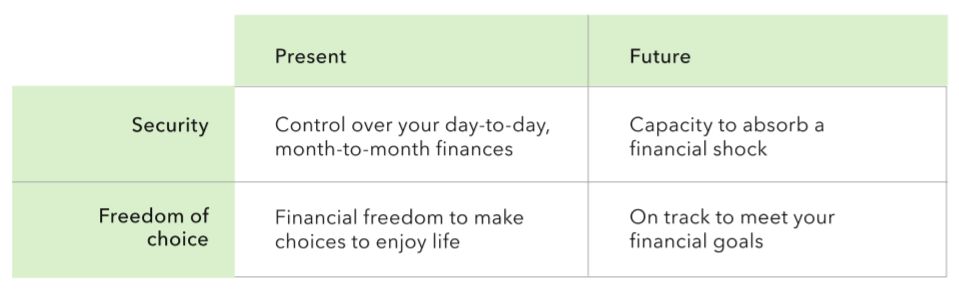

The Scale was developed after rigorous testing, and they wanted to define financial well-being the way consumers do. Ultimately financial well-being was defined as “a state of being wherein a person can fully meet current and ongoing financial obligations, can feel secure in their financial future, and is able to make choices that allow them to enjoy life.”

To put it a different way:

The Financial Well-Being Scale is used in a variety of ways, including:

- At the initial meeting to get a base score

- Tracking progress over time

- To assess program outcomes

- For research purposes, such as how scores relate to the level of credit card debt someone has

So what is a “good” score? The score that is produced doesn’t have any meaning – it is simply a base score. The more important measurement is whether or not their score is increasing over time.

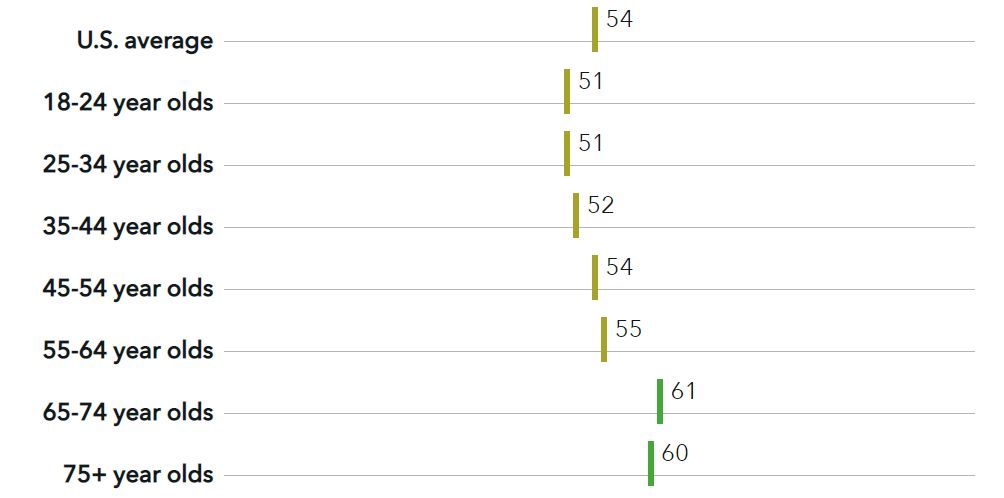

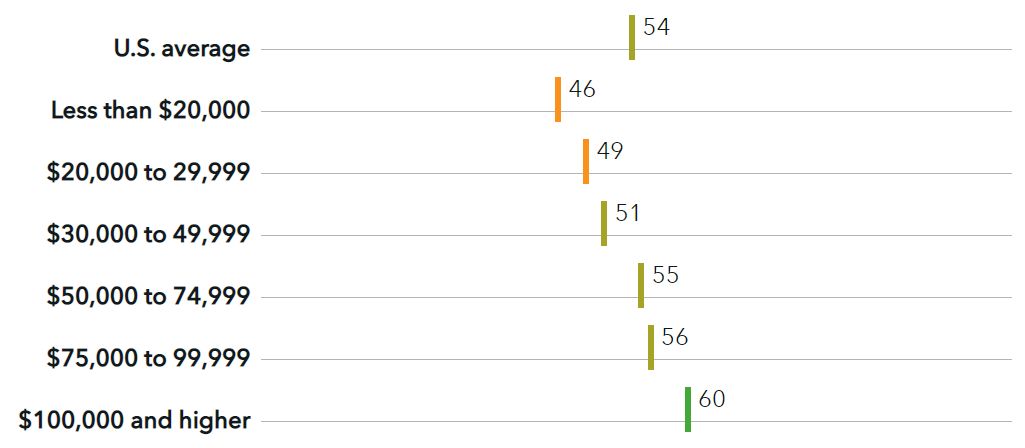

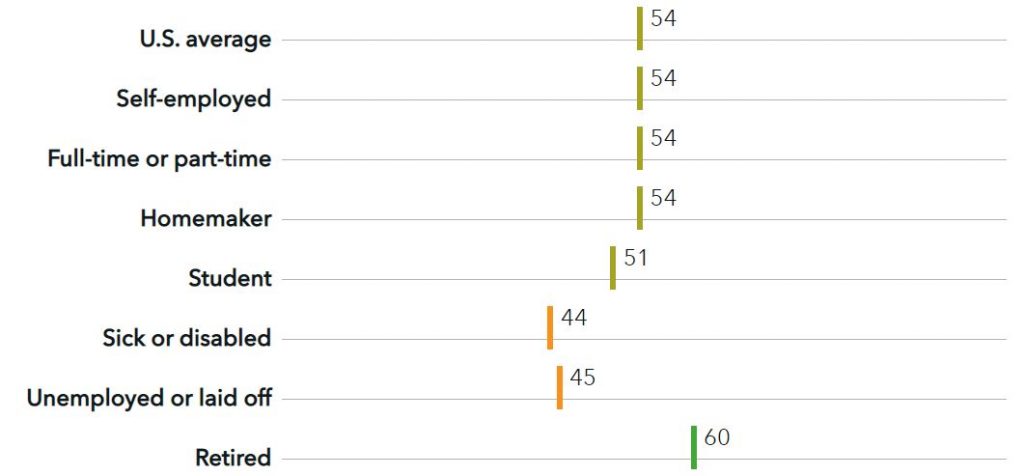

Research has shown some interesting things. Consider the following charts comparing the “average” score of 54 across ages, income level, and employment status:

One thing I like about the Scale is the discussions that can happen as a result. For example, if someone answered the question, “I could handle a major unexpected expense” with “Very Little” that leads to a discussion about emergency funds.

The Scale is only 10 questions long, and it can be administered on paper and hand-graded or done online and the scoring is done for you.

In the next article we will discuss ways to help clients improve their financial well-being.

Action Step:

- What is your score? Complete the Financial Well-Being Scale for yourself using either the paper version or the online version.

Leave a Reply