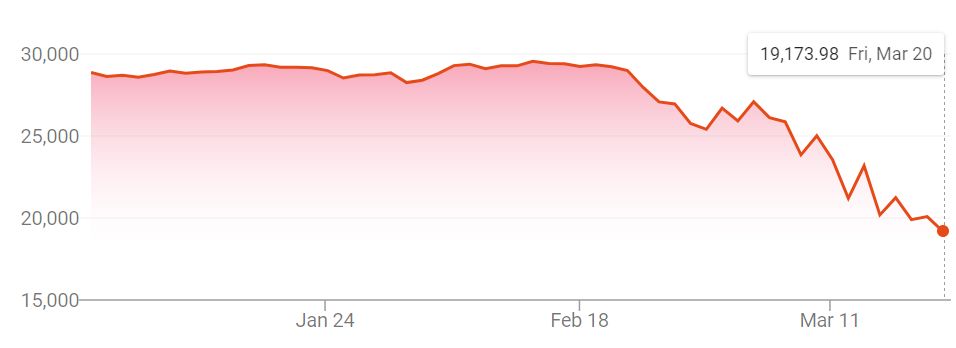

These graphs show the S&P 500 and DOW Jones averages since the beginning of 2020 through the close of the market on March 20, 2020:

Some “experts” are predicting it could go down another 20% before this is over. Maybe they are right. Maybe they are wrong. Maybe it will start going back up tomorrow, maybe it will drop another 30% or more. No one knows for sure. My crystal ball is out of order, so I certainly don’t know.

Investors are panicking and pulling money out of the market. I hear people use words like “stressful” “scared” and “worried” with only the occasional investor using the word “opportunity.”

Let’s address the stressed, scared, worried, panicking investors first.

If you have a financial advisor, this would be the time to call them. Actually, if they are a good financial advisor, they should have contacted you already. If they are avoiding you, it’s time to find a new advisor.

I could give you all the statistics about not missing the up days in the market, or not buying high and selling low, but stress and worry and being scared are emotions, not logic. Our brains have been wired to “fight, flee, faint, or freeze” when we deal with stressful situations, including stressful financial situations. Getting out of the market is our way of fleeing as we see our balances going down.

I would encourage you to pause. What are you investing for? Most people would say retirement or college or some other goal. What values are those goals based on?

Our behavior should be framed by our goals, which should be framed by our values. If your financial planner hasn’t done this with you, or if you don’t have a financial planner, here is an important question for you:

- Why is money important to me?

Write down whatever answer comes to mind first. Let’s say you thought “security.” Write down security then ask:

- Why is security important to me?

Keep this process going until you dig down to the deepest reason money is important to you. Don’t dismiss this as simplistic and unimportant! Pause the panic and do this exercise.

For me, money is important because it represents security, freedom, time, and the ability to support and spend time with my family. Money is simply a tool to help me live these values, and I invest in the market to help it grow. That is true in up markets, and honestly it is even more true in down markets.

For the average 40-year old they have years until they will need the money invested in the market, and years in retirement.

What about someone who is 60 and planning to retire in the next few years? First of all, you should probably be moving towards a more conservative portfolio if you don’t have time to weather the ups and downs of the market. If that describes you, it is time to talk to a financial planner. Remember, however, that you likely have 20 or more years in retirement. Don’t panic and sell now or you lock in the losses that are just on paper now.

Many people can’t understand how some investors see this as an opportunity. How is it an opportunity? The stock market is on sale! You can buy additional shares of stock or mutual funds right now at a steep discount. America and the world will recover from this, and the market will go back up. Maybe not tomorrow, maybe not next month, and maybe not this year, but it will recover.

Let’s say the stock of a company was trading at $30 a share and it is down to $15 right now. Instead of buying one share at $30 you can now buy two shares for that same $30. When the market recovers to $30 you now have two shares worth a total of $60. You can make much more money during a down market because of the discounts.

Can I share a few good investing principles with you to think about during the down times?

- Only look at your balance once a quarter, at the most. How is my portfolio doing? I have no idea. I haven’t looked at it. Not because I am worried or scared, but because I don’t care. I’m not investing for the short term.

- If you can put any extra money in the market right now, go for it!

- If your financial advisor is avoiding you or not dealing with the emotions of investing, it is time to start looking for a new advisor. Ask any potential advisor lots of questions and make sure you feel comfortable with them.

If you have questions or want to talk more, let’s have a conversation. Contact me or leave a comment below.

Leave a Reply