by Ryan H. Law

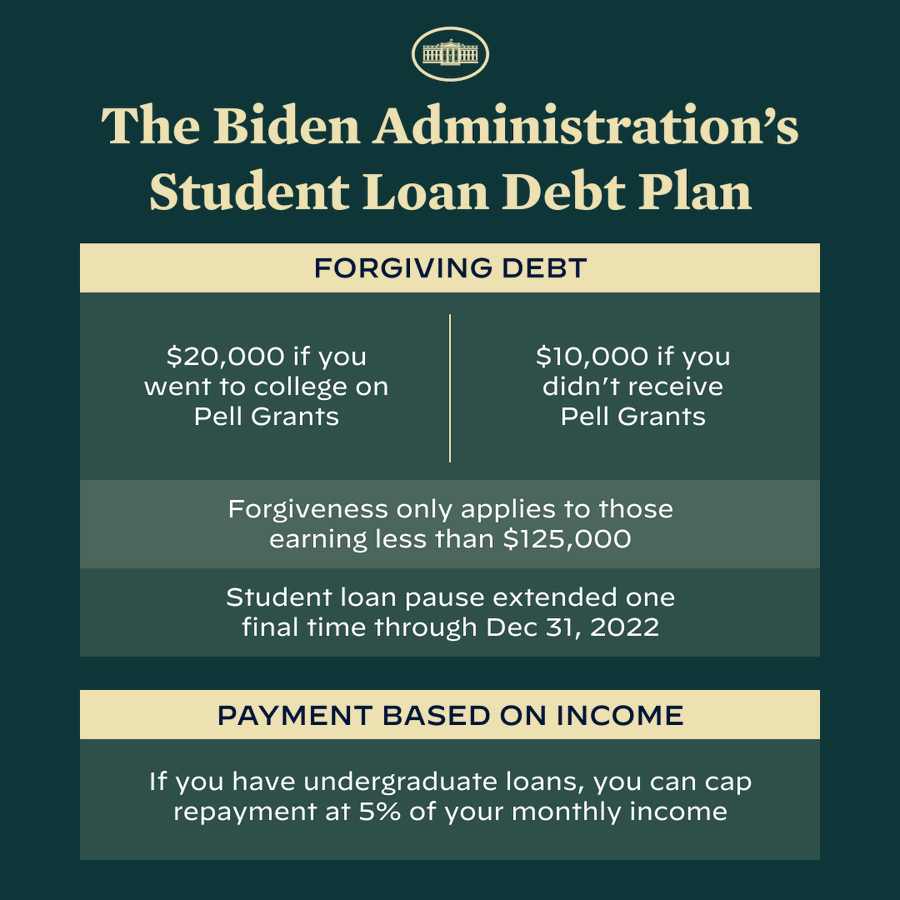

On August 24, 2022 the Biden Administration released the following graphic on Twitter:

Following the tweet, news from the White House and Department of Education have followed, though many questions still remain.

As expected, the response from members of Congress was mixed. Here’s two examples:

As far as the general public, most of those with student loans are excited about the news, though some wanted much more debt wiped out. Some without loans are happy for those that get this relief, while others are upset that they paid off their loans or never had any.

Let’s run through the mechanics of the plan, one piece at a time.

What are the income qualifications?

Only those who earn under $125,000 (single) or $250,000 (married) qualify. If you are single and make $125,001 you are over the limit and get no forgiveness. The Department of Education has said the income limit will be based on 2020 or 2021 tax returns.

Which loans qualify?

The forgiveness applies to loans held by the federal government. We know it will include Direct loans held by both undergraduates and graduates, and Parent PLUS loans. FFEL loans managed by the Department of Education will qualify, but other FFEL and private loans will not be included.

UPDATE: August 30, 2022: Privately-held FFEL loans may qualify. According to the Seattle Times: “The Department of Education is working with the outside entities that oversee the cancellation-ineligible FFEL loans, with the intention of making cancellation available for the borrowers who have those loans. The department encourages people who may not want to consolidate to ‘sit tight’ and await word on this effort.”

No loans taken out after June 30, 2022 qualify.

People have asked me how much they will have forgiven if they consolidated their undergraduate loans with their graduate loans. There is no official guidance on this yet, although I think that if you have any graduate loans you will max out forgiveness at $10,000. I will update this as more information is released.

UPDATE: Sept 6, 2022: Graduate loans are now eligible to receive up to $20,000 of relief. See more information under the next question “How much will be forgiven?”

The loans may have to be consolidated into a Direct Consolidation Loan, but borrowers should wait for official word before moving forward.

UPDATE: Sept 6, 2022: The Department of Education is now encouraging, “borrowers with privately held federal student loans, such as through the FFEL, Perkins, and HEAL programs” to consolide these loans into the Direct Loan program.

How much will be forgiven?

Everyone who has a qualifying loan and meets the income qualifications gets up to $10,000 forgiven. If the borrower received at least one Pell grant while they went to school they get up to $20,000 forgiven.

If a borrower has $8,000 in Direct Loans, they get $8,000 forgiven. They do not get a check for the other $2,000.

Graduate and Parent PLUS loans cannot get the additional $10,000 for Pell grant recipients – they are maxed out at $10,000.

UPDATE: Sept 6, 2022: The Department of Education has updated the guidelines, and Graduate and Parent PLUS loans are now eligible for up to $20,000 in forgiveness. To get the full $20,000, the borrower must have received a Pell grant for themselves. Here is a scenario:

Debra took out a total of $15,000 in loans for her undergraduate studies. Her parents took out $25,000 in Parent PLUS loans for Debra. Debra got married her senior year and qualified for a Pell grant of $2,500. She then went to graduate school and took out another $20,000 in federal loans. After graduation she consolidated her loans, then the COVID pandemic hit and her loans have been on pause ever since.

Assuming Debra and her parents both qualify for forgiveness, who will receive relief and for how much?

Debra: She has a total of $35,000 in consolidated debt, and she received one Pell grant, so she will get $20,000 of relief, leaving her with a balance of $15,000.

Debra’s parents: Debra’s parents automatically qualify for $10,000 in forgiveness, but if her parents received a Pell grant when they went to school, they qualify for up to $20,000.

Is the forgiveness taxable?

The White House and Department of Education have said this will not be taxable.

How do I take advantage of this?

If your income is on file with your servicer (i.e. you are on an income-driven plan) it should be automatic. I wouldn’t count on it, though, especially since no one has had to recertify their income for several years. Everyone else will need to fill out a form that has yet to be released. Education Secretary Cardona said it would be out before the end of the year.

Borrowers can sign up for updates on when the application is open at the Department of Education’s subscriptions page.

When will I have to start making payments again?

The payment and interest pause was pushed to the end of the year, so payments should begin January 2023.

That timeline will allow forgiveness to go through, but it also gives the economy (inflation) time to cool down, the holiday season to end, and midterms to be complete.

How does the new repayment plan work?

First, it is not a new repayment plan. It is a proposed plan. It will likely have some changes if it goes into place. The parameters of the plan are:

- Payment will be 5% of discretionary income for undergraduate loans. Some reports have said it will be 10% if you have graduate loans.

- Discretionary income is what remains after basics are paid for, and this is measured by using the Federal Poverty level. The traditional formula is AGI – 150% of the poverty level, but the proposal is to increase this to 225%. If you want to see a calculation, see the footnotes1.

- Any amount remaining after 20 years will be forgiven. Under current law that forgiveness will be taxable.

- If a borrower’s payment doesn’t cover the interest it will be covered by the federal government (in other words, no interest will accrue while a person is on this plan).

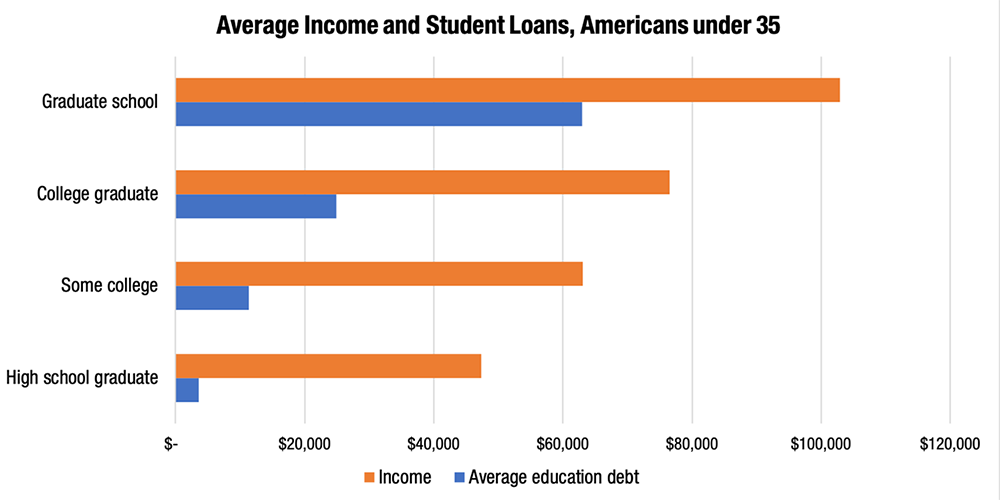

Who benefits the most?

About 32% of borrowers (14.6 million people) will have all of their student loans eliminated.

About 20% will have about half their balances wiped out.

While the benefit is supposed to be for lower-income Americans, the Penn Wharton Budget Model found that the plan favors higher-income Americans. About 70% of the forgiveness will go to the top 60% of wage earners, and those who earn between $82,400-$141,096 will receive the greatest share of overall forgiveness.

The most debt is held by the highest earners, so they will benefit the most:

How much will this cost?

According to the Penn Wharton Budget Model it will cost between $605 billion and $1 trillion dollars (this is revised from their original estimate of $300 billion). The Committee for a Responsible Federal Budget estimates it will cost about $500 billion.

Who pays for it?

This is debt held by and owed to the federal government. It is actually their number one asset.

Here is what President Biden said at his press conference:

I hear it all the time, “How do we pay for it?” We pay for it by what we’ve done.

Last year, we cut the deficit by more than $350 billion.

This year, we’re on track to cut it by more than $1.7 trillion by the end of this fiscal year. The single-largest deficit reduction in a single year in the history of America.

The point is this: There is plenty of deficit reduction to pay for the programs — cumulative deficit reduction — to pay for the programs many times over.

Remarks by President Biden Announcing Student Loan Debt Relief Plan

I’m not an economist, but according to everything I read (see here, here, and here for example), we had a budget deficit of $2.78 trillion dollars in 2021 and we are predicted to have a budget deficit of $1.41 trillion dollars in 2022.

All of that is added to the national debt.

Politicians get away with saying they cut the deficit because they spent less than they (or their predecessor) did the year before. So it’s technically true, but completely deceitful, and Presidents of both parties do it.

Look at it this way: If I earn $1,000 a year and spend $2,000, then I decrease my spending to $1,990, can I now spend an extra $10 since my deficit is reduced? If I do, I’ll never get ahead.

Cancelled student loans will be added to the national debt, and ultimately that debt is paid for by taxpayers.

Some groups, such as the fiscally conservative National Taxpayers Union Foundation, estimate that the cost of the forgiveness will be about $2,000 per taxpayer.

For a more detailed explanation of who pays for this, read this Forbes article.

Will this cause inflation to go up?

This is a tricky question. No money is being sent to anyone, so this is not like the checks sent out during COVID.

The average student loan payment is between $200-$300, and having your debt wiped out would normally mean that this money could now be used to buy more goods and services (which would drive up inflation – more demand than supply).

However, these borrowers have not had a payment for more than two years (since March 2020), so this money is already being saved or spent. Rising inflation has caused many borrowers to shift this money to housing, food, and transportation costs, so that money is already out in the market.

I am not an economist (I’m a personal finance guy – it’s not the same thing), so I could be wrong, but I personally don’t think it will have much, if any, of an inflationary impact.

Will this cause college costs to increase?

There is speculation that colleges will look at this and figure that every few years $10,000 will be forgiven, so they will raise tuition by $10,000.

Will this cause more student loans to be taken out?

I think it will. Students, even if they don’t benefit from the current forgiveness, might figure that $10,000 forgiven will be the standard going forward, so they might take out more loans in anticipation of that. I actually heard from some people asking if they should hurry and take out a Parent PLUS loan or other student loan and have the debt wiped out.

While I understand why they would be tempted to do this (free $10,000), there is no guarantee this forgiveness will hold up in court, and the cut off date for loans that can be forgiven is June 30, 2022. In addition, I don’t think you should take out a loan that you have no intentions of repaying.

Is this fair to those who paid off their debt or don’t have debt?

Of course not. Neither is bankruptcy, the PPP loan forgiveness, subsidies to certain market segments, the Savings and Loans bailout, TARP, the AIG bailout and others.

Cancelling debt for some is always going to be unfair to some other group.

Will this hold up in court?

It’s hard to say. It took President Biden about a year and a half to implement this because he wasn’t sure he had to authority to do this. He wanted Congress to do it. Even Nancy Pelosi said the President doesn’t have the authority to cancel student loan debt. She has changed her mind and now says that he does have that authority.

Some politicians have said the HEROES Act, which gives the President additional authority during wartime or times of emergencies, gives the President the ability to cancel debt. The emergency declaration for COVID is still in place, so both President Trump and Biden have used the HEROES Act to delay student loan payments and interest.

It is becoming increasingly unlikely that it will be challenged in court or that it would be reversed if it did go to court. While many politicians are saying forgiveness is a bad idea, few politicians would actually try to reverse it at this point. Telling people they are getting $10,000-$20,000 added back to their loans is probably not good public relations. They are trying to toe the line between those who are happy about loan forgiveness and those who are unhappy about it.

The Justice Department issued a 25-page memo about how the President (or more specifically, the Secretary of the Department of Education, has the authority under the HEROES Act to cancel loans. That memo can be found here.

Is this a good policy?

For some borrowers, this makes all the difference. One person told me that they will have $40,000 of their debt wiped out ($20,000 for each spouse) and that this will be a game changer for them. Some borrowers who are having their debt eliminated are starting to shop for homes or new vehicles, and they are now considering getting married and having children. Again, the impact for individuals is huge.

Is this good for the overall country and the economy? Probably not. The debt has to be paid eventually, so it could end up hurting us in the end. Remember all those checks we got from the federal government during COVID? At the time those checks seemed like they were heaven-sent, but they fueled inflation (along with supply chain issues and other factors).

The biggest issue for me, though, is that it doesn’t fix the problem. This is like hacking away at the leaves of a tree, believing it will make a difference, instead of taking out the roots.

There are two problems – higher education is too expensive, and the cost of student loans is too expensive.

College Affordability

This cost of college has gone up by 497% since 1985, which is about four times higher than inflation. Many people are being priced out of college. In addition, there are many degrees that don’t have high-paying jobs attached to them. Every school likes to highlight their engineers, lawyers, and doctors, but ignore those who got lower-paying jobs.

The availability of student loans have directly affected tuition costs. Former Secretary of Education William J. Bennett said that “increases in financial aid in recent year have enabled college and universities blithely to raise their tuitions, confident that Federal loan subsidies would help cushion the increase.”

Analysis (see here and here) has found that increasing student loan availability leads to a 60% increase in tuition for each additional dollar. So if the government gives another $1 in student loans or grants, tuition goes up 60 cents.

So how do we actually lower the costs of higher education? Here’s a sampling of ideas that have been proposed:

- More support from state governments

- Eliminate loans but send federal money to colleges that agree to keep tuition lower

- Reduce administrative positions

- Draw more from endowment funds

- Tax endowment funds

- Push for more students to go to a community college for the first 2 years

- Push for trade schools for those that want to have a trade

- More online learning

- More incentives for giving to colleges and universities

- Hold colleges and universities accountable for students who can’t find a job in their field

- Increase Pell Grants

I don’t know which of these policies would work. That’s the subject of a much bigger debate.

Student Loans are too Expensive

A quick search will find story after story of borrowers who have paid on their debt for years but still owe far more than they borrowed.

Here’s one example. “Chris” borrowed $79,000 to get a bachelor’s, master’s, and law degrees. Over time he has paid $190,000 on those loans and his current balance is $236,000. While Chris admits that he has made mistakes, he shouldn’t owe any more after paying more than double what he borrowed.

Another borrower on Twitter (Michelle) said she is a social worker who left graduate school 20 years ago with $52,000 in debt. She has made every payment and has paid about $48,000. Her balance is now $42,000.

Another borrower has paid $54,000 towards their $52,000 original loan balance, but still owes $30,000. They haven’t missed a payment for 11 years.

This is crazy. These loans are basically predatory loans and the system needs to change.

Here is what I think should happen:

- Eliminate origination fees. The federal government should not take 2-5% of every loan they make to students.

- Cap total interest paid – perhaps at a total of 5-10% over what is borrowed, so if you borrow $10,000 you pay back a total of $10,500-$11,000.

- Eliminate capitalization of interest (this is when interest, at numerous times during the repayment phase) is added to the principal balance.

These steps would go much further than a one-time elimination of $10,000.

Footnote

- The Federal Poverty Level for a family of 3 is $23,030. The traditional formula uses 150% of that number ($34,545). The new formula would use 225% of that number, or $51,817. Under the other Income-Driven plans, a person’s AGI would need to be above $34,545 to make a payment, but under the new plan a person’s AGI would need to be above $51,817.

To see what this would look like, let’s compare payments for a family of 3 with an AGI of $60,000 using IBR and the new plan:

* IBR: $60,000 – $34,545 = $25,455 Discretionary Income; Payment is 10% of DI, or $2,545 per year (or $212 a month).

* New plan $60,000 – $51,817 = $8,181 DI; Payment is 5%, or $409.15 per year (or $34 a month).

The difference is monthly payments is $178 per month, and that doesn’t include the interest subsidy.

Clearly this plan will be the preferred plan for many borrowers if it goes through.

Wow, great article. Really details what the proposal is all about. Thank you for including how this effects us as students now. Would love you read more on your insights.

Well-written summary on the topic, thank you!