by Ryan H. Law

How organized are most of your client’s financial records? If they are like most people their records consist of a few file folders or boxes, unopened envelopes and stacks of paper somewhere.

Obviously this is not an efficient system and it can be almost impossible to gather what is needed in case of an emergency or need. I have been teaching people how to organize their financial lives for some time, and came across an article from Michael Kitces titled Making The Data Gathering Meeting Into A Client-Centric Positive Experience.

In this post Michael talks about replacing the “data gathering” meeting with a “get organized” meeting. The idea is that doing a “get organized” meeting will be a positive experience for both you and the client, and you can gather a lot of information as you go.

I think this is a valid approach that could be interesting to try out. I would like to share a few different approaches about how to help a client get organized and how you could use this in an appointment with a client.

Think about all the financial paperwork your clients receive each month – either digitally or in the mail. In a typical month they might receive an investment statement, credit card bills, bank statements, and more. Some need to be checked for accuracy while others need to be filed for tax season. Some can be shredded and some need to be kept.

If it is tax season they will get even more financial documents each month. In addition to new ones they are receiving they also have documents that they will need to keep a copy of such as previous year tax returns, real estate documents and a will.

While there are countless financial filing “systems” that individuals have created, two stand out that were developed by financial authors or planners – David Bach’s File Folder System and the HomeFile Financial Planning Organizer Kit.

David Bach’s File Folder System

Bach’s system consists of 14 hanging folders and approximately 50 file folders. Each hanging folder is labeled with a different category such as:

- Tax Returns

- Retirement Accounts

- Household

- Credit Card DEBT

- Insurance

- Savings and Checking Accounts

As documents are received they are placed in the corresponding folder.

Bach’s system is simple and, beyond the cost of the folders, is free. Bach discusses his system in more detail here.

HomeFile Financial Planning Organizer Kit

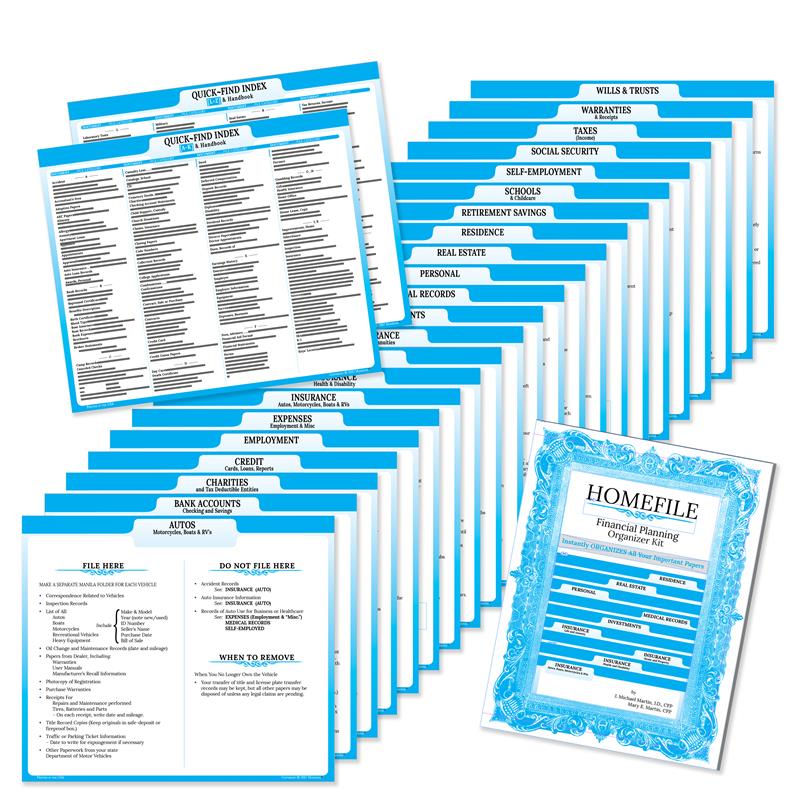

HomeFile was developed by financial planners J. Michael Martin and Mary E. Martin. It contains 22 laminated cards that are pre-labeled and are similar, though more detailed than, Bach’s system. Some examples include:

- Autos

- Charities

- Credit

- Employment

- Personal

- Real Estate

Each card is labeled with what is filed there, what is not filed there and when you can remove the document. The system includes a quick-find index so you can locate a document easily and a 48-page handbook with instructions and forms.

You can learn more about HomeFile here.

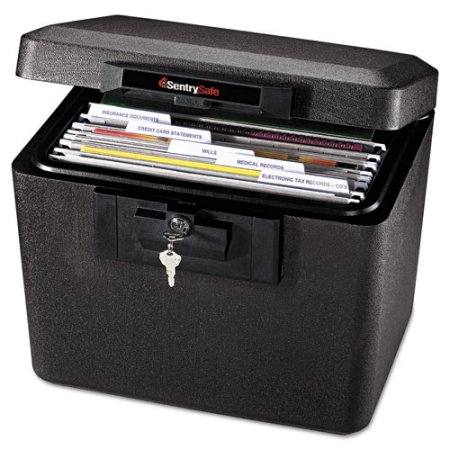

It is recommended that these types of files are kept in a file-proof locking box or safe. It may be advantageous to make it a portable box so it can be taken with you if needed.

ACTION STEP

- What system do you use to organize your personal finance documents? Could you personally benefit from adopting a more efficient system? Choose one way to better organize your financial documents.

- Consider how you might add this idea to your financial planning practice.

Leave a Reply